Know Your Pay: A Quick Guide to Net vs Gross Income

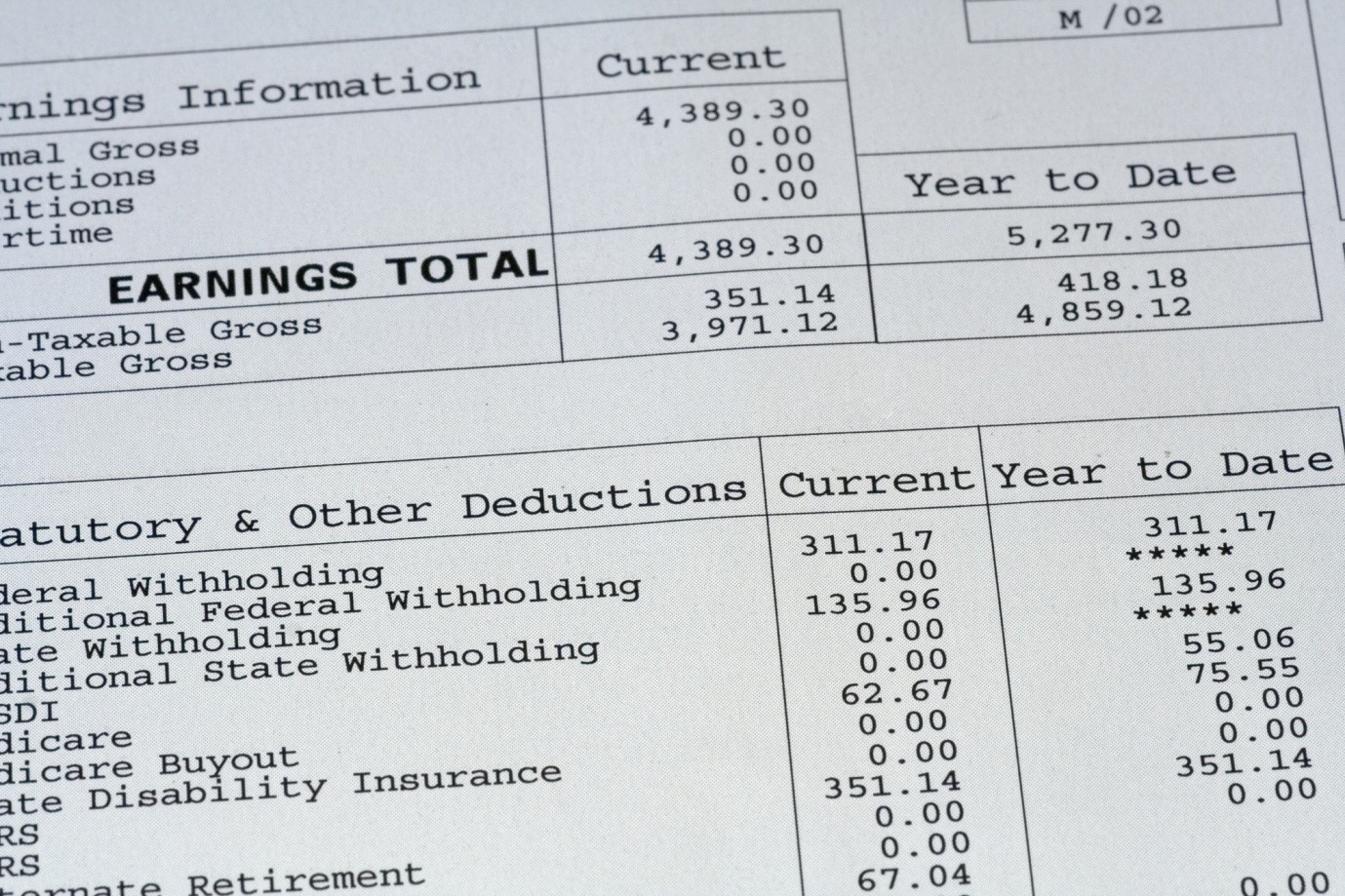

Let’s face it: Pay stubs have loads of information on them aside from the number you’ll see pop up in your bank account. However, not every piece of information on your pay stub is relevant to your financial needs.

What you’ll need to understand the most from your paystub are your net and gross income. What is the difference between net vs gross income? Here’s what you need to know.

What Is Gross Income?

To understand the differences between net vs gross income, let’s discuss each type, starting with gross. What is gross income?

Gross income, to somewhat simplify a complicated topic, is the base amount that you make from your job. This is the amount that your hourly wages, overtime, commissions, and other pay come up to before any deductions take place.

When most places look at income eligibility, they’re looking at your gross income, rather than your take-home pay.

What Is Net Income?

Now, let’s dig deeper into the other side of this equation. What is net income?

Net income is, in essence, the amount of money that you take home from your paycheck each week. For this reason, it’s often called your “take-home” pay.

It’s your gross income minus taxes and any other deductions that you may have from your paycheck.

What Gets Deducted From Your Paycheck?

Since your net income is your gross income minus deductions, you may wonder what’s getting deducted from your paycheck each pay period. Some common deductions taken out of your gross pay include:

- State and federal taxes

- Any company-based insurance plans

- Repayment of work-related expenses like uniforms

- Union dues

- Retirement savings

This is why your take-home pay often looks much lower than your gross pay. By the time all of your taxes, insurance policies, and other voluntary deductions get taken out, you can lose up to a third of your paycheck.

Where to Find This Information

Now that you understand the difference between net vs gross income, you may wonder where you can find this information. Thankfully, you don’t need a check stub maker to figure this out.

Your net pay is usually the amount written on the “check” part of your paycheck or pay stub. You’ll see your gross income up near the top of the check stub, followed by a list of the deductions taken from your pay.

Depending on your workplace, you may also see your year-to-date gross and net income listed on your paystub as well.

Net vs Gross Income: Let’s Review

So, what’s the difference between net vs gross income?

To review, net income is the amount you take home, while gross income is the amount that you actually make. Your gross income determines your eligibility for financial aid and credit, while your net income determines your standard of living.

If you need further clarification about the information on your paystub, or what you need to put on the paystubs of your employees, then check out our blog each day for more helpful articles like this one!